9 Best Shopify Payment Gateways in India

- What Are Payment Processors for Ecommerce Ơlatforms?Why Online Payment Systems Mater for Your Shopify Indian Store?Shopify payment gateways in India9 Best Shopify payment gateways for Indian businessesOur Top Pick: Cashfree for Indian Shopify Stores

- 1. PayPal2. Razorpay3. PayU Money4. CCAvenue5. Cashfree6. InstaMojo7. Atom Paynetz8. PayKun Payment gateway9. PayTM Payment gatewayShopify Payment Gateways in India: A Comprehensive ComparisonRegulatory Compliance for Payment Gateways in India

- RBI Payment Aggregator (PA) LicenseKYC RequirementsPCI DSS Compliance LevelsMobile Payment Optimization for Indian Customers

- Mobile Wallet IntegrationApp-Based PaymentsMobile Checkout Optimization TipsEmerging Payment Technologies in India

- Buy Now Pay Later (BNPL)UPI 2.0 and BeyondVoice-Activated PaymentsCrypto Payment SupportTips to choose payment gateways in India

- Tip 01: Payment options accessible on your Shopify India storeTip 02: International business transactionsTip 03: Duration of payment settlement on Shopify IndiaTip 04: Processing of refundsTip 05: Customer service

Since its inception in 2004, the worldwide DIY eCommerce hosting platform Shopify has been a huge success. After 21 years, as of 2025, Shopify has roughly 2.5 million active sellers in 175 countries, with 84,676 live stores in India, showing the platform’s tremendous growth in the region. And in India, the number of live Shopify stores is about 25,316.

Aside from marketing, merchandising, and inventory management, automatic payments can boost your productivity. When a client buys an item from your online store, Shopify payment gateways accept electronic payments in various currencies, from domestic to international and from credit cards to cash on delivery.

In this article, I will introduce you to the 9 best Shopify payment gateways in India, including transaction fees, supported payment methods, and tips to choose the most suitable option for your digital transactions.

What Are Payment Processors for Ecommerce Ơlatforms?

Payment processors are services that process credit card payments and other financial transactions for online and in-person stores. They act as intermediaries between your customers, your store, and the banking institutions involved in transferring funds.

When a customer makes a purchase, the payment gateway securely transmits the transaction information to the payment processor while implementing security features like tokenization to protect sensitive data.

Why Online Payment Systems Mater for Your Shopify Indian Store?

A payment gateway is a piece of payment processing technology that connects the client and the business. To securely take credit and debit card payments from your consumers, both online and in-person, you’ll need a payment gateway. The payment gateway secures the transmission of payment data from the client to the merchant, safeguarding all parties involved.

Shopify payment gateways in India

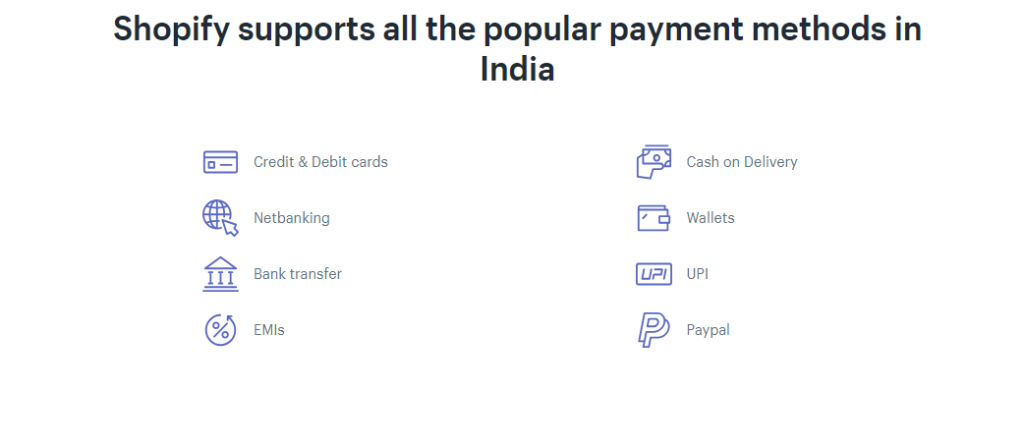

Shopify provides users in India with many payment methods, making it easier to check out.

They are:

- Credit & Debit cards

- Cash on Delivery

- Netbanking

- Wallets

- Bank transfer

- UPI

- EMIs

- Paypal

Moreover, Shopify allows you to select the best payment gateway for your clients. Below are the 9 best Shopify payment gateways for Indian businesses that you should take into consideration.

Exclusive Offer: Get Shopify 33 days for just $1 + The Online Store Starter Kit

Start your 3-day free trial, and enjoy your first month of Shopify for $1 plus the premium package designed especially for new Shopify merchants!

9 Best Shopify payment gateways for Indian businesses

Our Top Pick: Cashfree for Indian Shopify Stores

After analyzing all available options, we’ve identified the best payment gateway in India for Shopify based on overall value, features, and merchant feedback. Cashfree stands out for its competitive pricing and comprehensive features. With a transaction fee of just 1.75% for domestic payments and support for UPI, it’s ideal for businesses looking for cost-effective and versatile payment solutions. Their robust settlement dashboard and automated reconciliation features make financial management significantly easier for merchants.

1. PayPal

PayPal is a global payment platform that is available in over 200 countries worldwide. PayPal says that in 2014, it handled 4 billion payments (including 1 billion mobile payments). Paypal is used on a daily basis by over 173 million consumers.

As a result, if you expect orders from overseas customers, you must have PayPal linked to your eCommerce Store. PayPal supports over 100 currencies, with a fund withdrawal capability in 57 currencies and balances in their PayPal accounts in 26 currencies.

In India, retailers typically utilize PayPal to collect money from international consumers because an Indian company cannot take Indian credit cards via PayPal owing to banking laws.

Outstanding Features

- International Payment / Credit card Support: PayPal supports international payment methods for those who want to approach global markets.

- Multi-Currency Support: PayPal supports multiple currencies which are suitable for your customers

- Withdrawal Fees: There are no withdrawal fees on PayPal

- Settlement days: The platform will withdraw all your payments automatically to your local bank account on a daily basis.

- Number of Days Required to Begin a Transaction: No of Days. You can start right after successful registration.

- Integration of a Payment Gateway into a Mobile App: iOS and Android

- eCommerce CMS Systems Supported: Most of the popular ones are supported

Pricing

- Annual maintenance fee: zero, there are no maintenance fees.

- Transaction Fee: 4.4 percent + US$0.30 + currency conversion costs per transaction

Pros

- Global recognition and trust

- Simple integration with multiple SDK implementation options

- Excellent fraud protection with PCI DSS Level 1 compliance

- Comprehensive transaction analytics dashboard

Cons

- Higher transaction fees compared to local options

- No UPI support or mobile wallet integration

- Funds may be held for review

- Limited webhook integration capabilities for Indian merchants

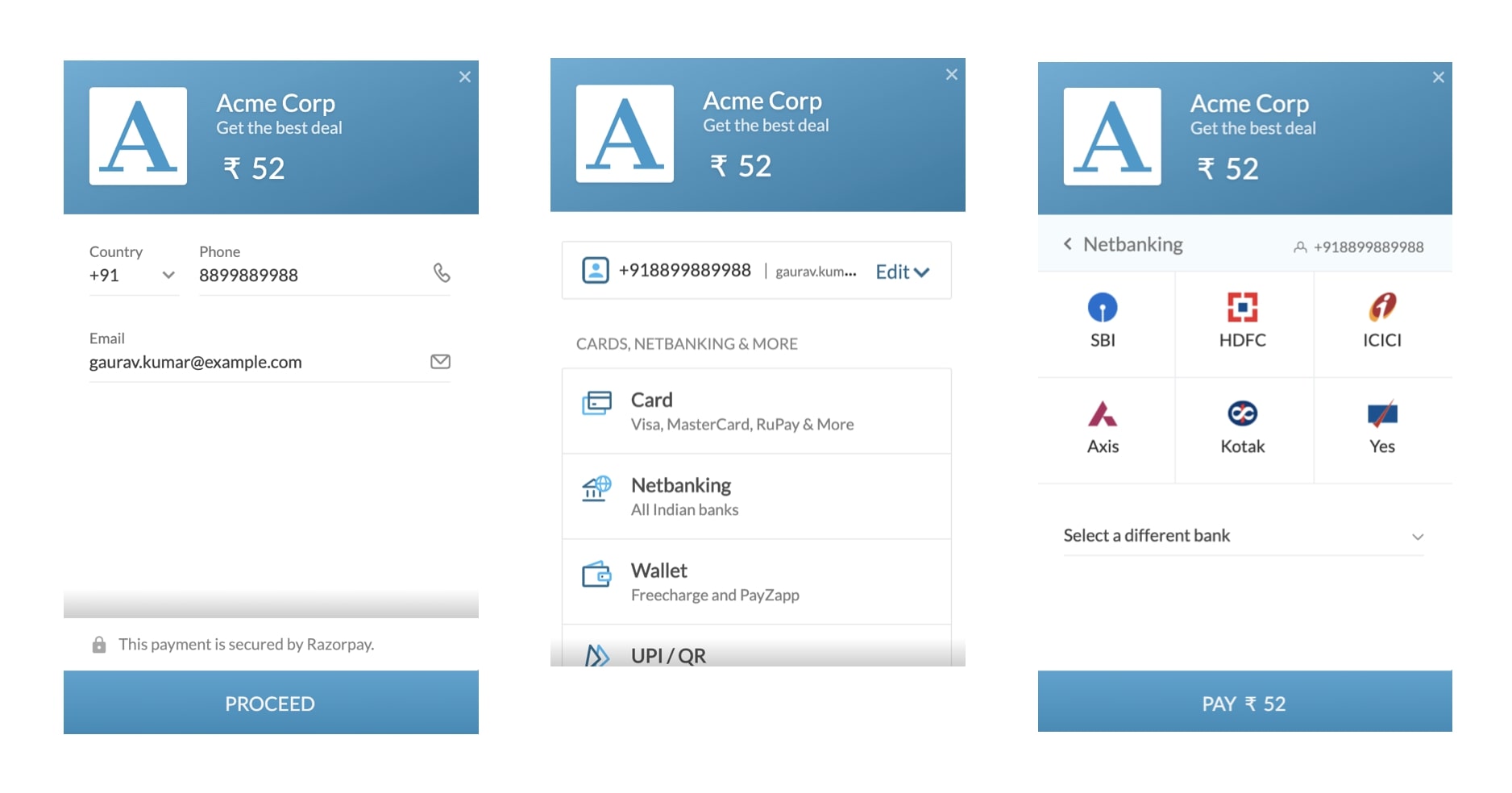

2. Razorpay

With its product suite, Razorpay is one of India’s leading payment service providers, designed specifically for the Indian market with full RBI Payment Aggregator (PA) license compliance. It supports all payment methods, including credit card, debit card, net banking, UPI, and popular wallets such as JioMoney, Mobikwik, PayUmoney, Airtel Money, FreeCharge, Ola Money, and PayZapp.

Features

- International Payment / Credit card Support: International approval is a different and lengthy process that is subject to bank approval.

- Multi-Currency Support: Does not provide assistance

- Withdrawal Fees: Zero

- Settlement days: Three days in your linked bank account.

- Customer Support: Chat support and IVR are accessible 24 hours a day, 7 days a week.

- Documentation required: The documentation list may be found here.

- Number of Days Required to Begin a Transaction: Activation is close to real-time. Subject to the approval of the papers.

- Integration of a Payment Gateway into a Mobile App: Mobile SDK’s for Android and iOS via Cordova/Phonegap

- eCommerce CMS Systems Supported: WooCommerce, Magento, CS-Cart, Opencart, Shopify, WHCMS, WordPress, Arastta, and Prestashop are among the most popular.

Pricing

- Annual maintenance charge: Zero, there are no maintenance fees.

- Transaction fee: Pricing is straightforward and transparent, with no hidden fees: 2 percent for each successful transaction; +1 percent for international cards, EMI, and American Express; no setup costs; There are no annual maintenance fees. The transaction charge is subject to an 18% GST.

Pros

- Comprehensive payment options

- User-friendly dashboard with detailed payment insights

- Excellent documentation and support

- Shopify payment gateway with UPI support in India

- Advanced mobile checkout experience optimizations

- Complete webhook integration for real-time event handling

Cons

- International payments subject to approval

- Higher fees for premium features

- Settlement dashboard requires technical configuration

Started my business with only 1$/month using the Shopify store

3. PayU Money

PayU (previously PayU Money) is one of the finest payment gateways for accepting online payments with little development work, a simple sign-up procedure, and a rapid onboarding process.

It supports over 150 payment methods, including credit/debit cards, UPI, net banking, and digital wallets, ensuring a versatile payment experience for customers. Users often commend its user-friendly interface and seamless integration capabilities, making it a preferred choice for many businesses.

However, some users have reported challenges, such as delayed settlements and subpar customer support. Despite these concerns, PayU’s robust security measures and extensive payment options position it as a reliable solution for businesses aiming to enhance their payment processing capabilities.

Features

- International Payment / Credit card Support: International payment is supported by Pay U

- Multi-Currency Support

- No Withdrawal Fees

- Settlement days: T+2 days

- Customer Support: Customer service appears to be quite busy all of the time.

- Documentation required: A lengthy collection of papers is provided.

- Number of Days Required to Begin a Transaction: 5-7 days

- Integration of a Payment Gateway into a Mobile App: Android, Windows, and iOS.

- eCommerce CMS Systems Supported: Pay U supports all major CMS.

Pricing

- Annual maintenance charge: Zero, there are no maintenance fees.

- Transaction fee: Each transaction is subject to a 2% + GST surcharge. Transaction fees for American Express and Diners Cards are 3% + GST for overseas transactions. For EMI payment alternatives, there is a set-up charge that must be paid in addition to Annual Maintenance Charges (AMC). Furthermore, the transaction charges are 3% + ₹6 for each transaction.

Pros

- Easy integration with Shopify via REST API

- Reliable customer support

- Strong security measures with PCI DSS compliance

- UPI support and comprehensive mobile checkout experience

- Detailed transaction analytics for business intelligence

Cons

- Relatively higher settlement time

- Interface can be complex for beginners

- Limited customization for checkout UI

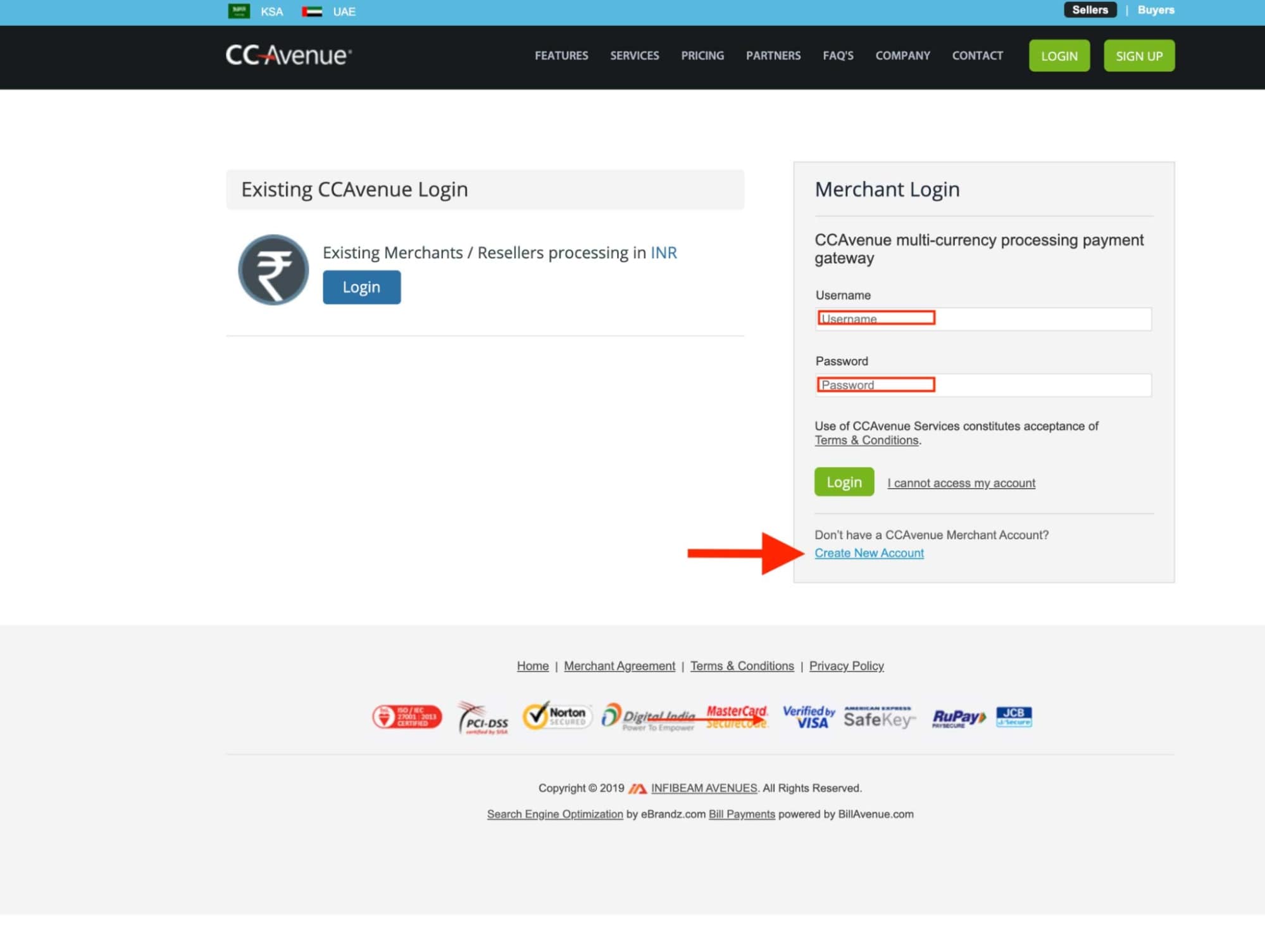

4. CCAvenue

CCAvenue is one of India’s major payment gateways, with a diverse range of payment methods. It accepts 200+ payment methods, including six credit cards: Amex, JCB, Diners Club, Mastercard, Visa, and eZeClick. It also supports 27 major currencies, allowing you to service clients in some of the world’s most important marketplaces outside of India. CCAvenue also has a Multilingual payment page that supports 18 major Indian and foreign languages.

Features

- International Payment / Credit card Support: CCAvenues does support international payment.

- Multi-Currency Support: CCAvenue accepts payments in 27 main international currencies, allowing your customers to pay in the currency they are most familiar with such as Indian Rupee, Singapore Dollar, etc.

- No Withdrawal Fees

- Settlement days: CCAvenue makes payments on a weekly basis for sums more than Rs. 1000, the minimum amount needed to be retained.

- Customer Support: Their website promises to provide voice, chat, and email assistance 24 hours a day, seven days a week. However, their conversation was interrupted over the weekend. The IVR system expressly states that they are closed on weekends. Their sales and technical staff, on the other hand, responds quickly and works effectively together internally.

- Documentation required

- Number of Days Required to Begin a Transaction: CCAvenue promises on its website that all new merchant accounts are active within one hour of registration, but in fact, it might take anywhere from three to six days. Before you begin transacting using their payment gateway, CCAvenue will authorize your website and request actual copies of papers.

- Integration of a Payment Gateway into a Mobile App: Android, Windows, and iOS.

- eCommerce CMS Systems Supported: CCAvenue provides APIs for the majority of shopping carts, including Buildabazaar, Cubecart, Drupal, Interspire, Joomla, Magento, Magento Go, Martjack, Moodle, NopCommerce, Opencart, OsCommerce, PrestaShop, VirtueMart, WHMCS, WordPress, and ZenCart.

Pricing

- Initial Setup Fee: Zero, there are no setup fees.

- Annual maintenance fee: Rs 1200

- Transaction fee: Domestic credit and debit cards on Visa, Mastercard, Maestro, and RuPay: 2% flat fee; Wallets (Freecharge, Mobikwik, OlaMoney, Jiomoney, Paytm, PayZapp, Jana Cash, SBI Buddy, and The Mobile Wallet): 2% flat cost; IMPS and UPI: A flat fee of 2% is charged; Visa, Mastercard, American Express, JCB, and Diners Club International Credit Cards: 3% flat cost; Taxes are additional since they are levied from time to time.

Pros

- Extensive payment options

- High reliability and robust automated reconciliation

- Strong brand recognition

- Comprehensive SDK implementation options

Cons

- No UPI support or mobile wallet integration

- Integration can be complex

- Customer service issues reported

- Limited payment insights compared to competitors

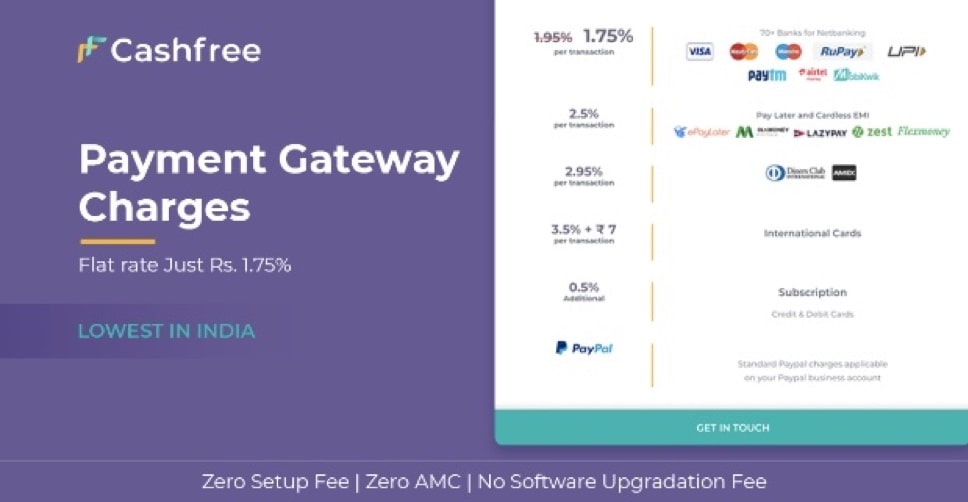

5. Cashfree

In India, Cashfree is a well-known payment gateway. It offers the most payment methods, including debit and credit cards, 75+ Netbanking alternatives, Paytm, and 6 major mobile wallets such as Airtel, Mobikwik, and Freecharge. In addition, they provide the most PayLater and cardless EMI alternatives, including ZestMoney, OlaMoney postpaid, and others. Cashfree also accepts UPI, NEFT, IMPS, and PayPal payments. Cashfree’s payment gateway costs just 1.75 percent each transaction, which is India’s lowest TDR rate. Furthermore, they have the shortest settling period, ranging from 24 to 48 hours. Cashfree also has an Instant Settlements function that allows companies to receive the money within 15 minutes after receiving payment.

Cashfree provides a feature-rich dashboard for creating orders and collecting payments, as well as the most connectors — for both websites and mobile applications. Payment gateway connections are available to businesses in a variety of configurations. Cashfree has created ready-to-use eCommerce payment gateway plugins for platforms such as Shopify, Woocommerce, Magento, and OpenCart, among others.

Features

- Domestic Cards and Internet Banking Options: Visa, Mastercard, Maestro, RuPay, and 75+ net banking

- International Payment / Credit card Support: Visa, Mastercard, and American Express are all on board. Paypal connection with Cashfree is available, allowing you to provide Paypal as a payment method. Begin taking foreign payments right away.

- Recurring Payment or Subscription Management: Collect subscription payments via links or API. Subscription plans can be customized.

- Multi-Currency Support: Foreign currencies in excess of 32 are supported. Other currencies can be configured upon request.

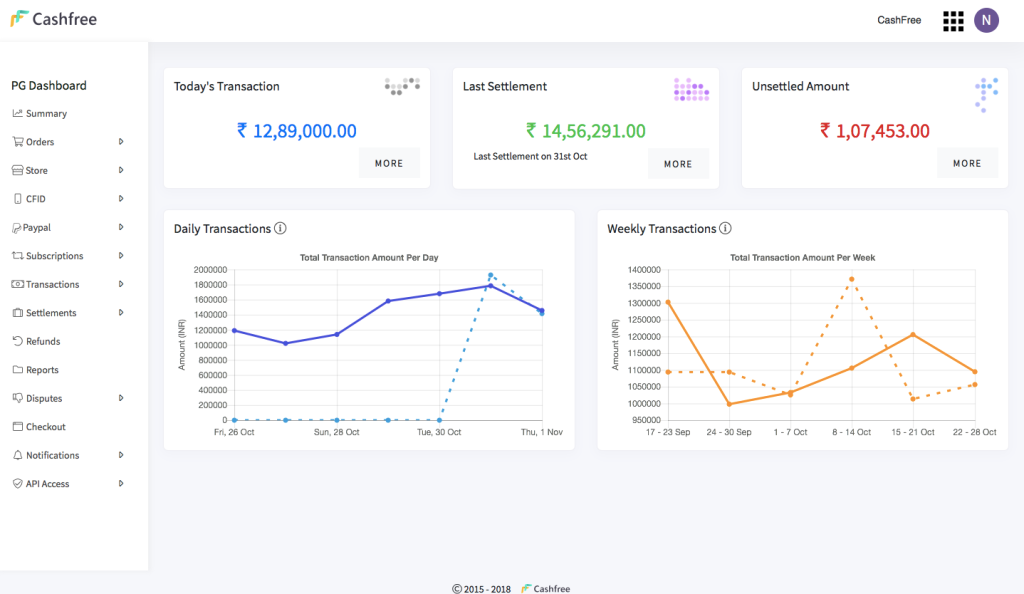

- Smart analytics: Live transaction reporting, comparison of monthly collections and modes of payment, daily reporting of settled and unsettled transactions

- Customer Support: Each account is allocated a dedicated Account Manager who serves as a single point of contact. Mon-Saturday, live chat assistance is available.

- Documentation required: Users are completely able to process online. Cashfree requires only a scanned copy of the canceled cheque, PAN Card, and address proof.

- Integration of a Payment Gateway into a Mobile App: Android SDK, iOS SDK, Reach Native, Flutter SDK, Cordova SDK, Xamarin Android SDK, and Xamarin iOS SDK.

Pricing

- Initial Setup Fee: Zero, there are no setup fees.

- Annual maintenance fee: Also zero

- Minimum Annual Business Requirement: Zero

- Transaction fee: Credit and debit cards on Visa, Mastercard, Maestro, RuPay, and 75+ online banking: 1.75 percent flat charge + Rs 0 per transaction; Wallets: Paytm, Airtel Money, Freecharge, Mobikwik, Ola Money, Jiomoney: 1.75 percent flat fee + Rs 0 per transaction; UPI: 1.75 percent flat charge + Rs 0 every transaction; Visa, Mastercard, and American Express International Credit Cards: 3.5 percent flat charge + Rs 7 per transaction; Taxes are additional since they are levied from time to time.

Pros

- Lowest transaction fees Shopify payment gateway in India

- Fast settlement cycles (T+1)

- Excellent dashboard and reporting with conversion tracking

- Responsive customer support

- Superior mobile checkout experience

- Complete REST API and webhook integration

Cons

- Relatively newer compared to established players

- Some advanced features require custom integration

- Limited international recognition

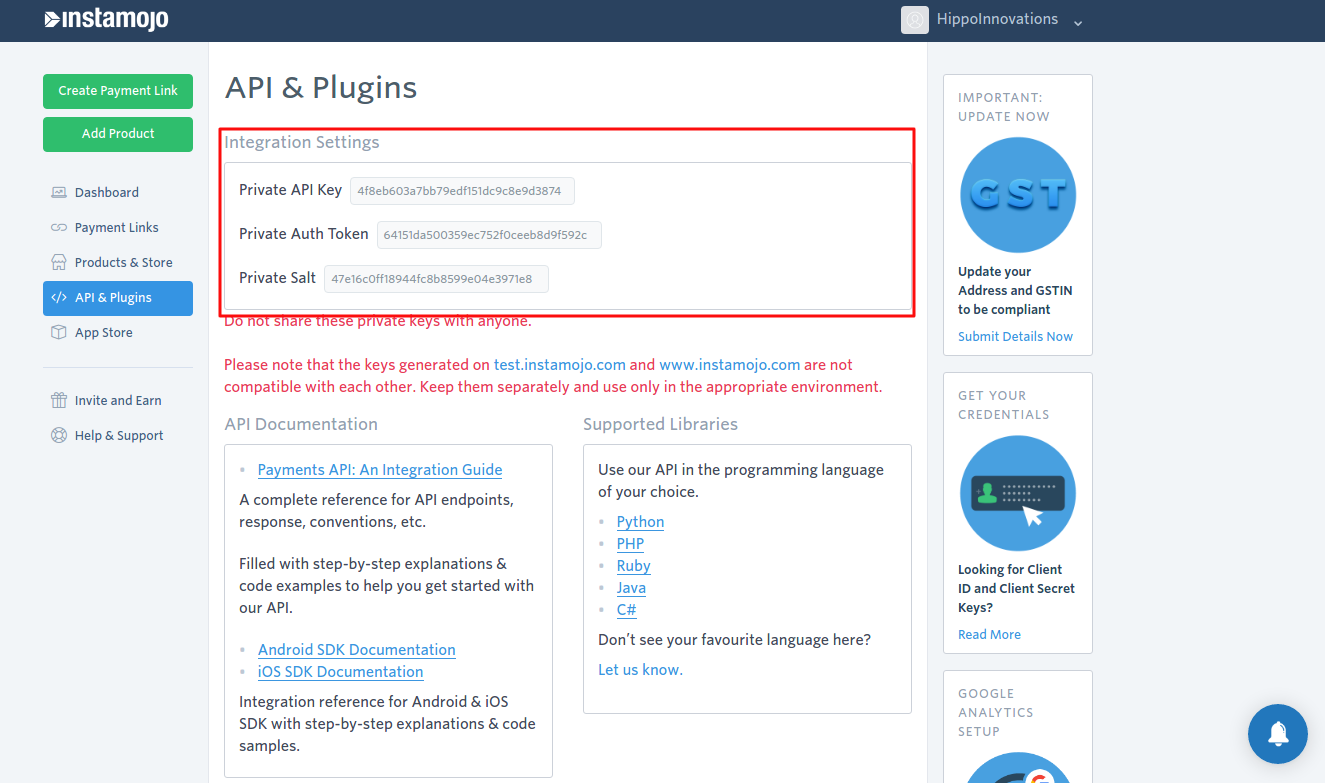

6. InstaMojo

Instamojo Payment Gateway enables new businesses to rapidly register a merchant account in order to accept online payments with or without a website. InstaMojo’s fees are extremely affordable.

Features

- International Payment / Credit card Support: InstaMojo does not support international payment

- Multi-Currency Support: Not support

- Settlement days: 3 days in the bank account that you connected

- Withdrawal Fees: Zero

- Customer Support: Their IVR system states unequivocally that they are closed on weekends. On weekdays, though, our call went unanswered.

- Documentation required: After you join up with them, you will be able to view their documentation list.

- Number of Days Required to Begin a Transaction: After just entering your email address, you will be able to begin receiving payments.

- Integration of a Payment Gateway into a Mobile App: Android, Windows, and iOS.

- eCommerce CMS Systems Supported: All major ones such as Magento, Prestashop, Opencart, etc.

- Integration of a Payment Gateway into a Mobile App: Not available as of now.

Pricing

- Annual maintenance fee: Zero, there are no annual maintenance fees.

- Transaction fee: Flat fee @ 2% + Rs 3 per transaction

Pros

- Quick and easy setup

- No monthly fees

- UPI support and mobile wallet integration

- User-friendly interface

- Simplified automated reconciliation

Cons

- Limited international payment options

- Higher per-transaction fee

- Fewer advanced features

- Basic webhook integration capabilities

- Limited reporting compared to premium options

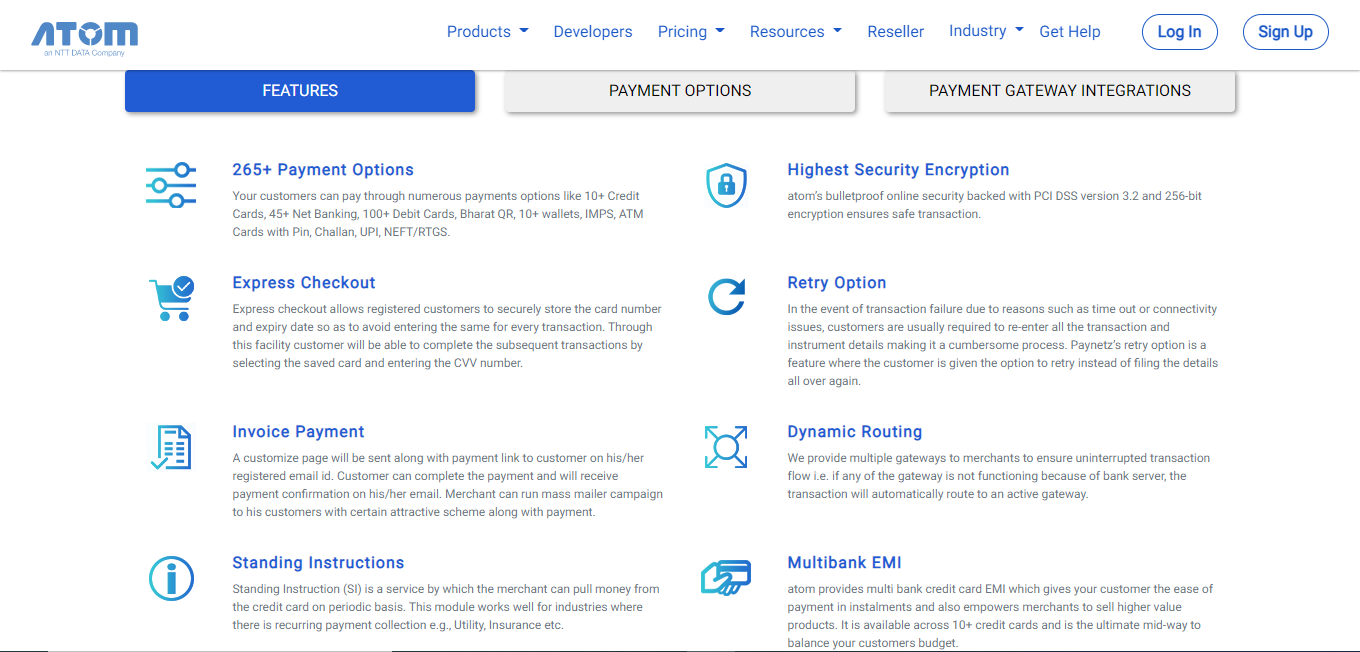

7. Atom Paynetz

Atom is sponsored by FT Group and is a forward-thinking Payment Service Provider with over 100 payment choices, 15 million+ transactions, and 4500+ merchants around the country.

Features

- Domestic Credit Cards supported: Visa, Master, AMEX, Diners, JCB, Discover

- No Withdrawal Fees

- Customer Support: It is difficult to reach their telephone number and chat facility on the website. As a result, you should go to the Contact us page and use the numbers to get to the Atom Paynetz service team.

- Documentation required: Mostly Business Registration documents and a PO are required

- Number of Days Required to Begin a Transaction: Within 5-6 days

- Integration of a Payment Gateway into a Mobile App: Android, Windows, and iOS.

- eCommerce CMS Systems Supported: All major CMS supported such as Magento, WooCommerce, Prestashop.

- Integration of a Payment Gateway into a Mobile App: Android only for now

Pricing

- Annual maintenance fee: The first year will be free, however, in the second year, Atom Paynetz requires users to pay Rs 2400.

- Transaction fee: Credit Cards: 2.1%; Debit cards: for transactions less then Rs 2000 it is 0.75%; Debit cards: for transactions more then Rs 2000 it is 1%

Pros

- Lower rates for debit card transactions

- Good customer support

- Reliable processing

- Solid PCI DSS compliance level

- Basic transaction analytics

Cons

- No UPI support or mobile wallet integration

- Less intuitive interface

- Limited integration documentation

- Basic webhook support

- Limited mobile checkout optimization

8. PayKun Payment gateway

PayKun is a payment gateway service provider that allows buyers and sellers to conduct safe and secure transactions. There are several satisfied merchants who have joined and are still active today who have grown their businesses with the assistance of PayKun.

Any organization, large or small, individual, trust, NGO, eCommerce, or other entity may easily register on PayKun and utilize the payment gateway to receive online payments. Customers will have several payment methods available to them when they use the PayKun checkout.

Features

- International Payment / Credit card Support: PayKun does not support international payment

- Multi-Currency Support: Not support

- Settlement days: T + 1 to T + 3 business days. It depends on the business model and payment mode.

- Withdrawal Fees: Free

- Documentation required: It is dependent on the type of the business- business KYC and more.

- Number of Days Required to Begin a Transaction: Within an hour

Pricing

- Setup cost: Free

- Annual Maintenance Charges: Zero. No hidden charges

- Transaction fee: Flat 1.75% taxes as applicable

Pros

- Competitive pricing

- Easy integration with Shopify

- Responsive support

- UPI support and good mobile checkout experience

- Streamlined KYC requirements process

Cons

- Limited international payment options

- Newer in the market

- Fewer advanced features

- Basic SDK implementation options

- Limited payment insights

9. PayTM Payment gateway

PayTM has developed as a prominent payment provider as a result of its online consumer base and the ‘PayTM Cash’ wallet. Paying using Paytm may therefore be advantageous for a small eCommerce shop.

Features

- International Payment / Credit card Support: PayTM does support international payment

- Multi-Currency Support: More than 72 currencies

- Domestic Credit Cards supported: Visa, Mastercard, Maestro, RuPay, Amex, ezeClick, JCB, and Diners

- Settlement days: Settlement usually takes 1-2 days. PayTM also provides the option of real-time / same-day settlement.

- Withdrawal Fees: Zero

- Documentation required: New merchant accounts need to provide business registration and bank account details.

- Number of Days Required to Begin a Transaction: After submitting all required paperwork, the merchant may go live using the Paytm Payment gateway in two days.

- Integration of a Payment Gateway into a Mobile App: Android, Windows, and iOS.

Pricing

- Initial setup fees: Rs 5000

- Annual maintenance fee: Rs 5000

- Transaction fee: 1.99% for Paytm wallets, Net banking, and Credit cards. 0.4% for transaction amount below Rs. 2,000 via Debit cards (Mastercard & Visa) / 0.9% for amount above Rs. 2,000; 0% for Rupay card and UPI; 2.8% for international Credit/Debit cards; 0% Transaction fees for all startups (Build for India Offer).

- Minimum annual business requirement: Zero

Pros

- Strong brand recognition

- Widely used PayTM wallet

- UPI support and superior app-based payments

- Special startup program

- Comprehensive transaction analytics

- Fast automated reconciliation

Cons

- Account setup can be lengthy with extensive KYC requirements

- Customer service can be slow

- Integration documentation needs improvement

- Complex webhook implementation

Shopify Payment Gateways in India: A Comprehensive Comparison

To help you make an informed decision, here’s a detailed comparison of Shopify payment gateways in India highlighting key features:

Payment Gateway Transaction Fee UPI Support Mobile Wallet Integration 2FA/Security Automated Reconciliation Settlement Time PCI DSS Level BNPL Support PayPal 4.4% + $0.30 + currency conversion No No Yes/Tokenization Yes 2-3 business days Level 1 No Razorpay 2% +1% for international/EMI Yes Yes Yes/OTP & Tokenization Yes T+1 Level 1 Yes PayU Money 2% + GST, 3% for international Yes Yes Yes/OTP Yes T+1 to T+3 Level 1 Yes CCAvenue 2% domestic, 3% international No Partial Yes/Tokenization Yes T+2 to T+3 Level 1 No Cashfree 1.75% domestic, 3.5% international Yes Yes Yes/OTP & Tokenization Yes T+1 Level 1 Yes InstaMojo 2% + ₹3 per transaction Yes Partial Yes/OTP Basic T+1 to T+3 Level 2 No Atom Paynetz 2.1% credit, 0.75%-1% debit No No Yes/OTP Basic T+2 Level 2 No PayKun 1.75% + taxes Yes Partial Yes/OTP Basic T+1 to T+2 Level 2 No PayTM 1.99% various, 0% for startups Yes Yes Yes/OTP & Tokenization Yes T+1 to Regulatory Compliance for Payment Gateways in India

When choosing a payment gateway for your Shopify store, understanding the regulatory landscape is crucial. The Reserve Bank of India (RBI) has implemented specific guidelines that all payment processors must follow:

RBI Payment Aggregator (PA) License

As of 2022, all payment gateways in India must obtain a Payment Aggregator license from the RBI. This ensures the payment processor meets strict financial and operational requirements. All gateways covered in this guide maintain proper PA licensing, though their specific compliance implementations may vary.

KYC Requirements

Know Your Customer (KYC) verification is mandatory for all merchants using payment gateways in India. The process typically requires:

- Business registration documents

- PAN card details

- Bank account information

- Address verification

- Director/proprietor identification

PCI DSS Compliance Levels

The Payment Card Industry Data Security Standard (PCI DSS) establishes security requirements for organizations handling card information. Gateways like PayPal, Razorpay, and Cashfree maintain Level 1 PCI DSS compliance—the highest security level—while others may have Level 2 or 3 certification.

Mobile Payment Optimization for Indian Customers

With over 750 million smartphone users in India as of 2025, optimizing your checkout for mobile devices is no longer optional—it’s essential. Here’s how to enhance your mobile checkout experience:

Mobile Wallet Integration

Integrating popular mobile wallets like PayTM, PhonePe, and Google Pay significantly improves conversion rates. Gateways like Razorpay, Cashfree, and PayTM excel in this area, offering seamless mobile wallet integration.

App-Based Payments

For Shopify merchants with mobile apps, supporting app-based payments reduces friction. This includes integration with UPI apps that allow customers to complete transactions with a simple scan or click.

Mobile Checkout Optimization Tips

- Minimize form fields – Collect only essential information on mobile

- Implement one-tap payments – Enable saved payment methods

- Optimize load times – Ensure your checkout pages load quickly on mobile networks

- Use mobile-friendly design – Ensure buttons are large enough for thumbs

- Enable QR code payments – Popular in the Indian market for contactless transactions

Gateways like Razorpay and PayTM offer specialized mobile optimization tools that can significantly improve your conversion rates on smaller screens.

Emerging Payment Technologies in India

The Indian payment landscape is rapidly evolving. Stay ahead by understanding these emerging technologies:

Buy Now Pay Later (BNPL)

BNPL services have grown exponentially in India, with options like:

- LazyPay

- Simpl

- ZestMoney

- PayTM Postpaid

Gateways including Razorpay, PayU Money, Cashfree, and PayTM now offer BNPL integration, allowing customers to split payments without traditional credit cards.

UPI 2.0 and Beyond

The Unified Payments Interface continues to evolve with new features like:

- Recurring mandates

- Verified merchants

- Higher transaction limits

- Invoice in the inbox

Ensure your chosen gateway supports the latest UPI innovations to maximize conversion potential.

Voice-Activated Payments

Though still emerging, voice commerce is gaining traction in India. Some forward-thinking payment processors are beginning to explore integration with voice assistants for frictionless transactions.

Crypto Payment Support

While regulatory clarity is still developing, several payment gateways are preparing for potential cryptocurrency payment support. This remains a niche option but could become more significant in coming years.

>>See more:

- Shopify India Pricing 2025: All Costs and Fees Explained

- How to Start with Shopify Dropshipping In India

- Most Successful Shopify Stores in India: Discover The Gems

Tips to choose payment gateways in India

Tip 01: Payment options accessible on your Shopify India store

Internet banking, cards (Visa, Mastercard), and UPI are some of the most popular domestic payment methods. Mobile wallets like Paytm, Amazon Pay, and Ola Money are other popular forms of payment. Check to see if your payment gateway accepts cards such as Rupay, Maestro, and American Express, as this has a direct influence on your income.

On-Delivery Payment

Cash On Delivery (COD) accounts for more than half of all online transactions in India. Although it may not be your preferred method as a business, your consumers will prefer Cash on Delivery, especially if they are unfamiliar with your website.

Shopify India has observed this trend as well and has just launched the Advanced COD app, which allows you to build a personalized buying experience for COD purchases.

Processing refunds for Cash on Delivery purchases, on the other hand, is a common complaint among e-commerce firms. Many of our Shopify India merchants told us similar tales about putting in a lot of effort to gather payment information and then having the finance staff arrange for refunds. In the next sections of this guide, we will go through refund handling.

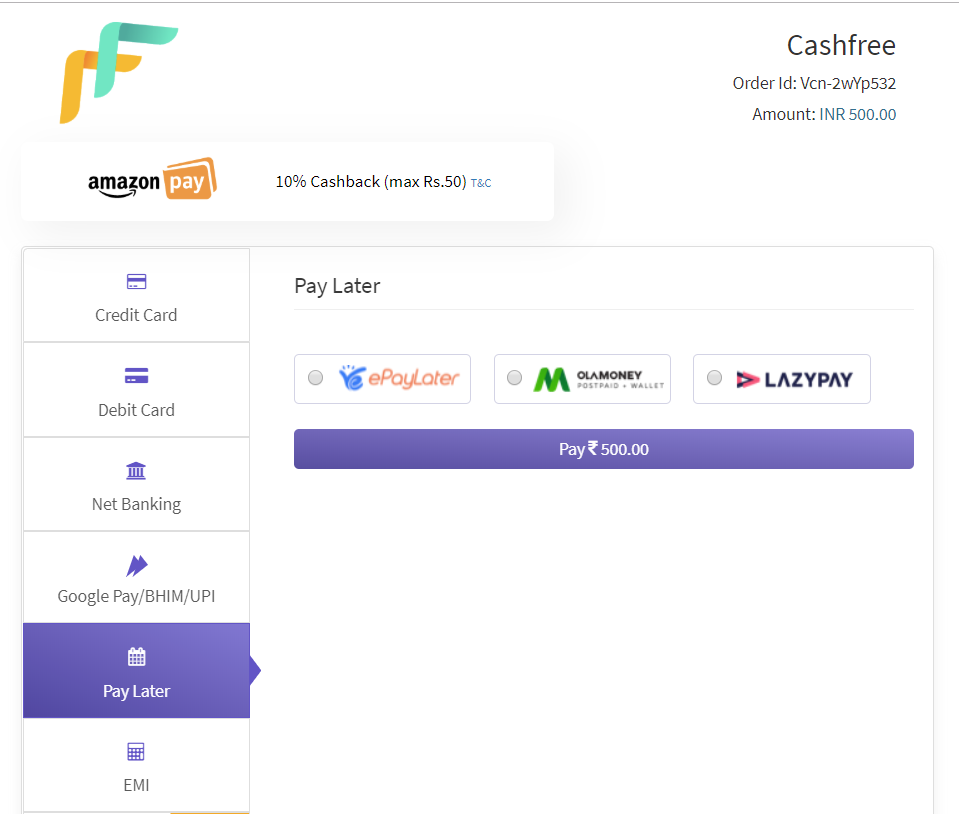

Options for EMI and Pay Later

EMI and Pay Later credit alternatives are now available on Shopify India. The EMI option can significantly increase conversions for high-value transactions such as electronics and jewelry. Banks offer EMI credit on credit cards, but independent firms such as Zestmoney and Flexmoney also provide cardless financing.

On the other hand, the Buy Now, Pay Later option via ePayLater or OLA Money Postpaid provides a very quick and seamless checkout experience that is best suited for low-ticket size transactions.

Tip 02: International business transactions

One of the primary reasons businesses prefer to operate their operations through a Shopify shop is the worldwide reach it gives. If you have clients outside of India or customers in India who use international cards, it is critical that you accept payments via international cards and other common international payment methods such as Paypal.

However, getting accepted for an international payment gateway is time-consuming and challenging for small to medium-sized enterprises that use Shopify. As a result, for many Shopify India shops, the convenience of activating foreign payment alternatives is critical.

Foreign currencies

Customers outside of India will want to pay in their home currency to avoid incurring currency conversion fees. Check to see if your international payment gateway supports different foreign currencies if you have customers outside of India.

Shopify PayPal Integration

Paypal is the most trusted and preferred payment method for consumers all over the world. Paypal, in addition to accepting all payment methods such as credit cards and direct debit from bank accounts, provides buyer protection. Thus, including PayPal as a checkout option might significantly boost your conversion rate.

Tip 03: Duration of payment settlement on Shopify India

The time it takes for the seller’s account to be credited after the buyer’s account has been debited is referred to as the settlement duration. Consider the case of a client who pays using his HDFC debit card to better understand the payment settlement cycle.

- The customer submits payment information.

- The payment gateway collects information.

- The payment gateway encrypts the data before securely transmitting it to HDFC for verification.

- The transaction is approved by HDFC, and funds are sent to the payment gateway and subsequently to the merchant’s account.

Typically, this process takes two to four bank working days. When banks are closed on weekends and other bank holidays, there are delays. A lengthier settlement cycle implies that your revenue will be trapped with intermediaries such as banks and payment gateway providers, resulting in decreased fund liquidity. Choose a payment gateway with a shorter settlement cycle.

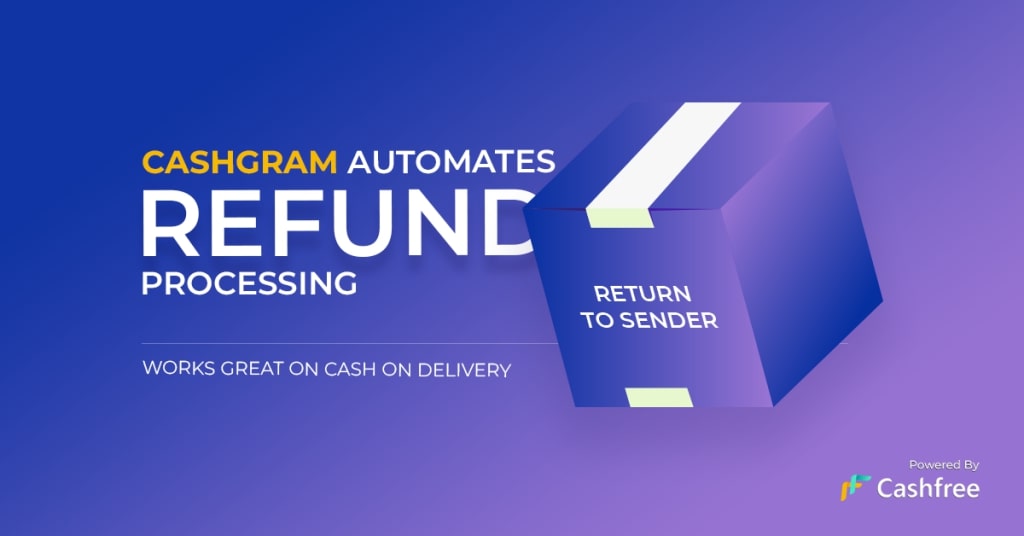

Tip 04: Processing of refunds

Return policies differ from one retailer to the next. When an order is canceled or a refund has to be handled, handling it in a timely and professional manner is just as essential as the product you’re selling in terms of customer satisfaction.

While a refund can be initiated quickly, processing by banks and card networks, as well as crediting the client account, takes significantly longer – 5-7 working days on average, and even longer for specific institutions and cards. This becomes much more difficult for cash on delivery orders, as there is an additional step of first obtaining the user’s bank data.

Handling support inquiries about refunds becomes a big operational problem as a result.

Cashfree has devised methods for processing refunds in real-time. Unlike other payment gateways, Cashfree provides Payouts as an immediate, automatic money disbursal option. This provides an easy method for companies to pay users and enables quick refund processing.

In the case of COD refunds, if the client’s payment information is not accessible, you can send the customer a Cashgram to gather payment details and quickly deliver the refund amount.

Tip 05: Customer service

As your partner, your payment gateway provider must collaborate with you. Take a look at reviews and consult with your colleagues before settling on a certain payment partner. It is ideal if you can have a dedicated account manager who will serve as your single point of contact for any difficulties that may emerge.

Tip 06: Analytics for Shopify India shop transactions

When your company begins to expand, you’ll need a payment gateway that provides frequent transaction statistics. These indicators are necessary to make sound business judgments.

Cashfree payment gateway has created user-friendly smart analytics boards that not only show you a summary of transactions but also provide insights such as your Payments Volume, Number of Transactions, and the distribution of your payments across payment methods and platforms (iOS, Android, Desktop), among other things. You may further examine this data by grouping it by hours, days, weeks, or months across any time period.

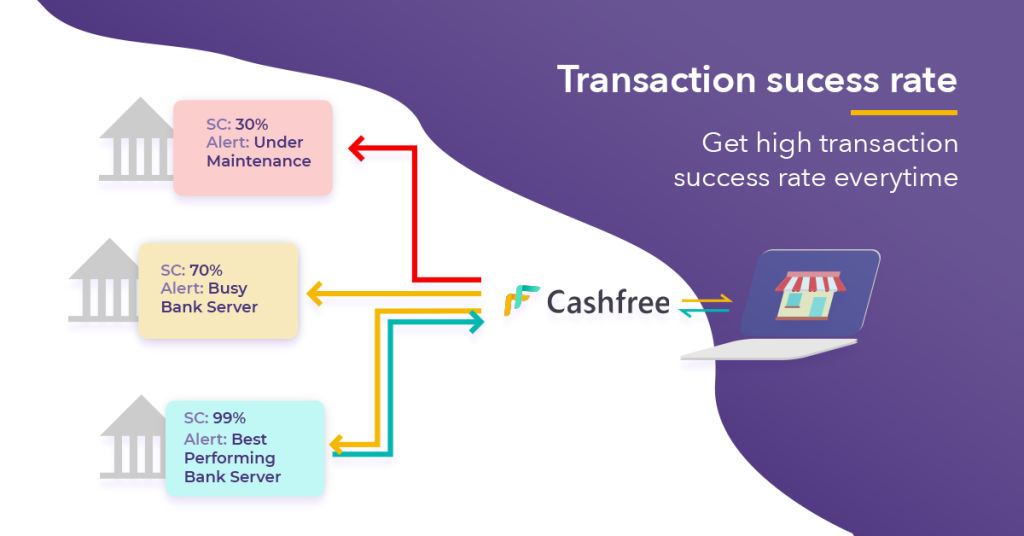

Tip 07: The success rate of transactions

Failure to accept payments is a nightmare for any internet business. When a payment is taken from a customer’s account but the transaction fails, the problem worsens. Not only does it impede that specific transaction, but it also has an impact on the general impression of your brand, and your potential customer may not return.

Payments frequently fail to owe to a fault at the payment gateway’s or bank’s end. To address this issue, certain sophisticated payment gateways rely on dynamic routing.

Cashfree’s clever algorithm, for example, determines the highest-performing gateway based on success rates. In the case of a shutdown, scheduled maintenance break, or overburdened bank servers, Cashfree’s sophisticated algorithm detects the decrease in success rates and instantly redirects the transaction through another bank’s gateway. This guarantees that the conversion numbers are constantly on the higher end of the scale.

Tip 08: Pricing for Shopify payment gateway

Finally, payment gateway price is an essential consideration that you should have in mind. Payment gateway fees include a startup fee, a yearly maintenance fee, and a per-transaction cost.

- AMCs (Annual Maintenance Charges): Fees for utilizing the payment gateway. It covers the payment gateway’s running costs. AMC is usually waived by most contemporary gates.

- Setup fees: Setup fees are levied to cover the costs of onboarding a new merchant or as a security deposit. Many payment gateways also waive the setup charge. Discover How to “Setup Payment Gateways on Shopify”

- Transaction Fees: Regular fees for delivering services. The fees may differ based on the manner of payment. Costs for utilizing net banking, for example, will be cheaper than charges for using foreign cards.

- Note: According to Shopify India Pricing, Shopify charges an additional.5% to 2% for every transaction, depending on the plan chosen for utilizing the e-commerce platform. So, while negotiating payment gateway prices, keep in mind that you will be paying Shopify transaction fees plus payment gateway fees on each transaction.

See more: Shopify All Fees And Cost Breakdown

Shopify Payment Gateways India: FAQs

Is Shopify Payment available in India?

No, Shopify Payments is not currently available in India. Shopify merchants in India need to rely on third-party payment providers to accept payments on their online stores. This means additional transaction fees and potentially more complex setup processes compared to countries where Shopify Payments is available.Which payment gateway is best for Shopify India?

For Shopify merchants in India, Razorpay is the top choice due to its extensive range of payment options, competitive pricing, robust features, excellent customer support, and strong reputation in the Indian market.While other options like Cashfree are also strong contenders, Razorpay’s comprehensive offering makes it the best payment gateway for most businesses, providing a seamless and efficient payment experience for merchants and customers.Is Shopify payment not available in India?

Yes, you are correct. Shopify Payments is not currently available in India. Shopify merchants in India need to use third-party payment providers to process payments on their stores.What is the charge of Shopify payment gateway in India?

Shopify Payments is not available in India, so there is no direct charge from Shopify for this service. However, you will incur charges from the third-party payment gateway you choose to integrate with your Shopify store. These charges typically include:

- Transaction fees: A percentage of each transaction, usually around 2-3%.

- Setup fees: Some providers may charge a one-time setup fee.

- Monthly fees: Some providers may charge a monthly fee for using their services.

Can I use Shopify as a payment gateway?

Shopify itself is not a payment gateway, but it offers a payment solution called Shopify Payments for eligible merchants. However, Shopify Payments is not available in all countries, including India.If you’re in India, you cannot use Shopify Payments and will need to integrate with a third-party payment gateway to accept payments on your Shopify store. Shopify integrates with a wide range of payment gateways that cater specifically to the Indian market.Conclusion

It might be tough to select a Payment Gateway for your eCommerce store if you are running a startup, small business, or brand. Therefore, I hope this article will help you find the top best payment gateways in India and start growing your business.

Sam Nguyen is the CEO and founder of Avada Commerce, an e-commerce solution provider headquartered in Singapore. He is an expert on the Shopify e-commerce platform for online stores and retail point-of-sale systems. Sam loves talking about e-commerce and he aims to help over a million online businesses grow and thrive.Related Post